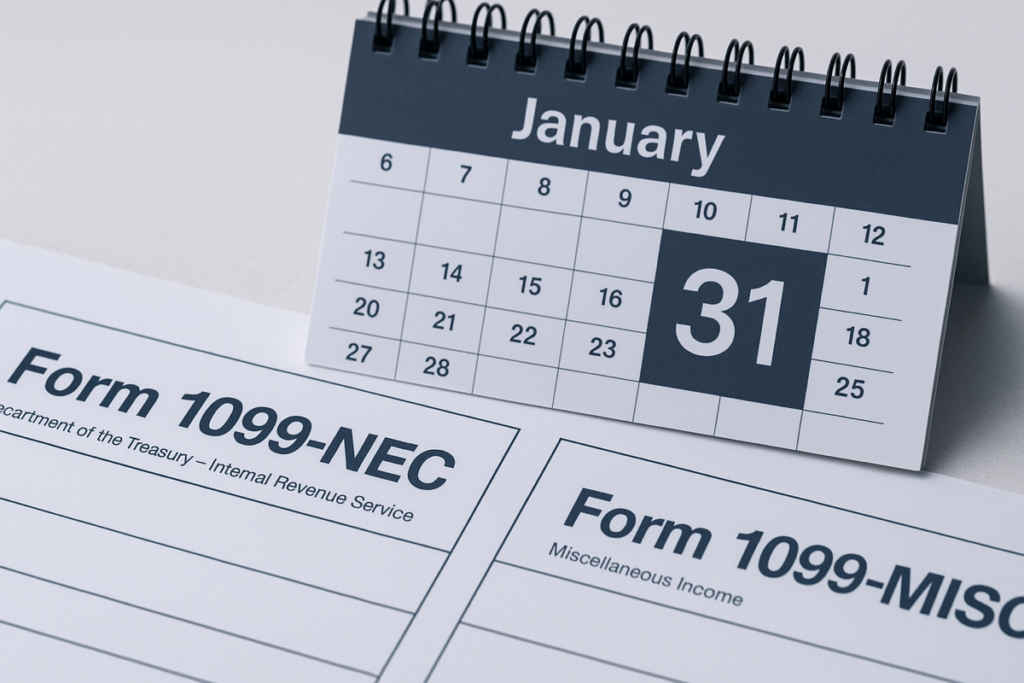

Created: Wednesday, February 18, 2026

Upcoming Tax Changes for 2026 and 2027: What to Know Now

While many taxpayers are still gathering their documents to file their 2025 taxes, we are looking ahead to changes coming in 2026 and 2027. Knowing what’s coming can help you avoid surprises and take advantage of new opportunities.