Adoption of ASU 2016-13 Measurement of Credit Losses on Financial Instruments (CECL) will have a significant impact on financial institutions and their allowance for loan and lease loss (ALLL) calculation. After many delays, the effective date of CECL for private companies is less than a year away. Now is the time to make sure you are on track to successfully implement your CECL model to estimate an allowance for credit losses by January 1, 2023 (for entities with a December 31 fiscal year-end).

The first Call Report due under the new standard will be for the reporting period ending March 31, 2023.

Where should you be in the CECL implementation process?

As you continue throughout 2022, keep the following suggested target dates in mind.

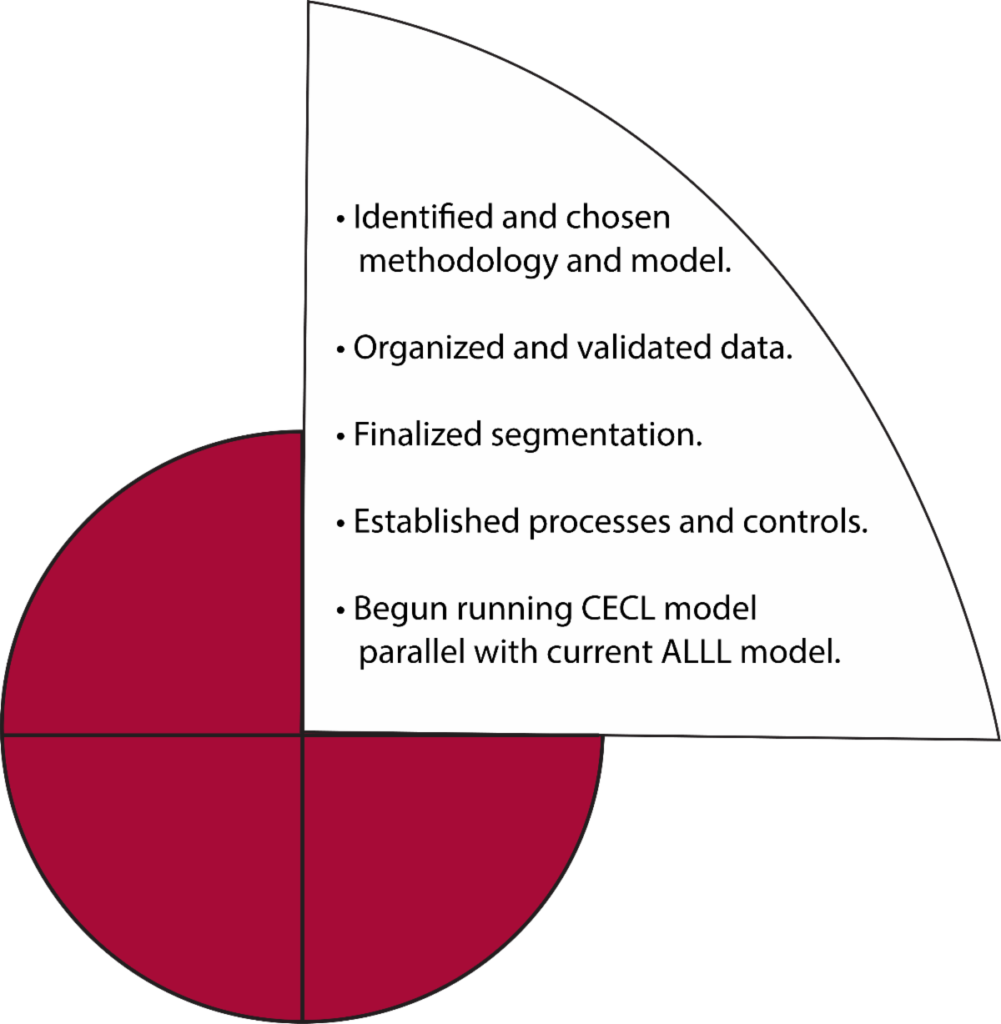

Completed by end of 1st Quarter 2022

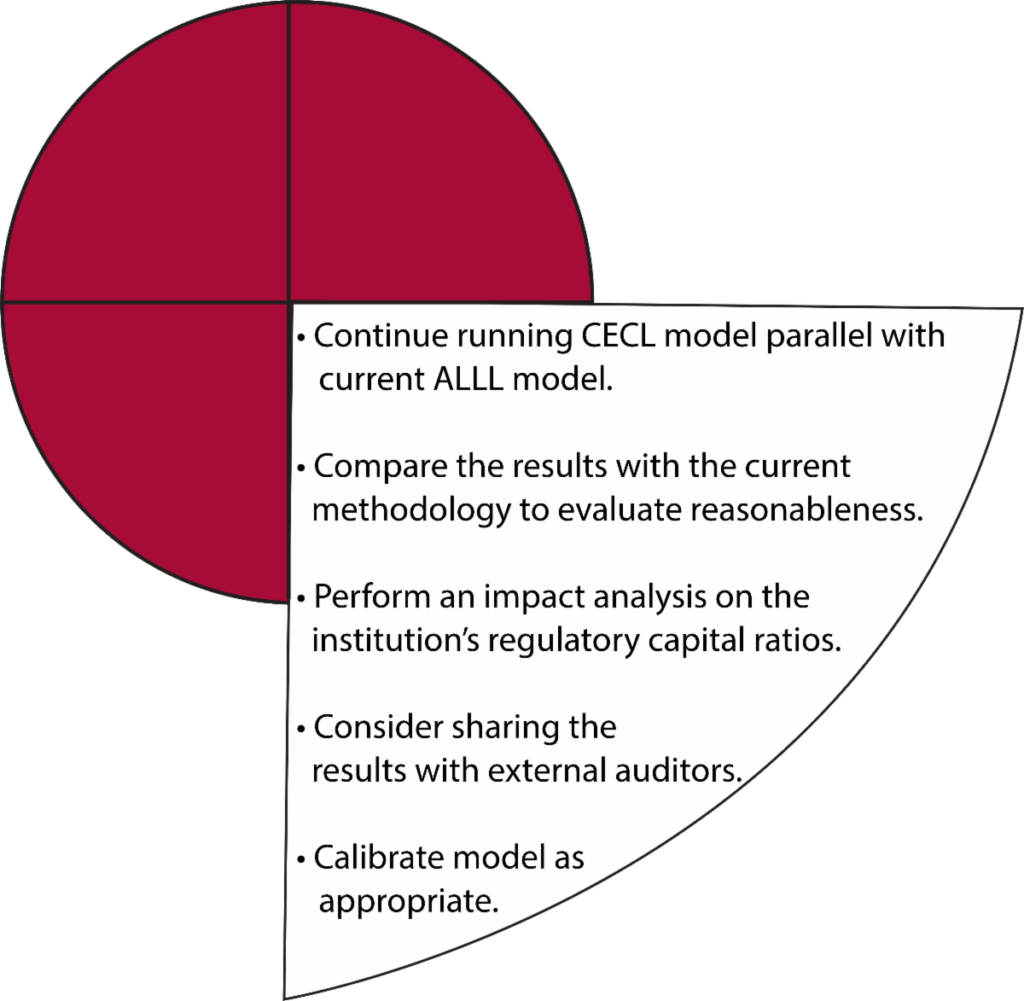

2nd Quarter 2022

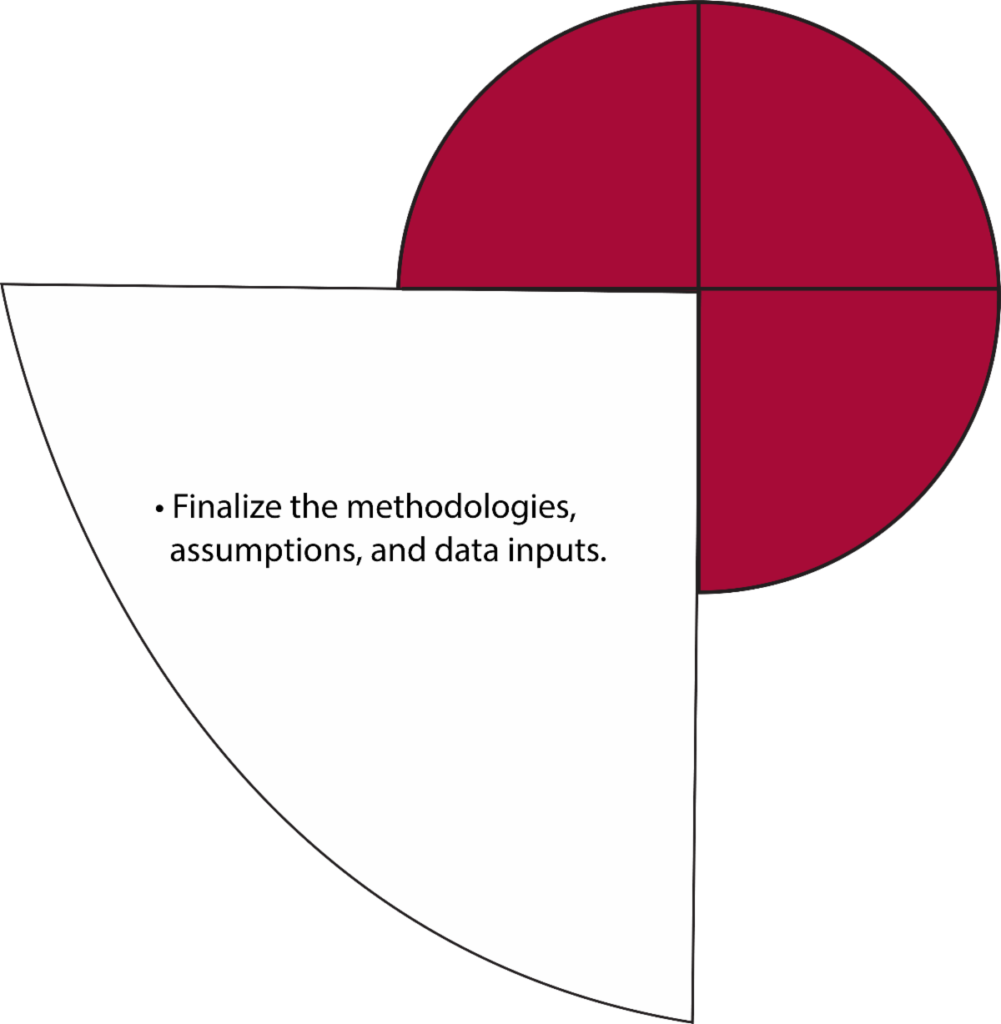

3rd Quarter 2022

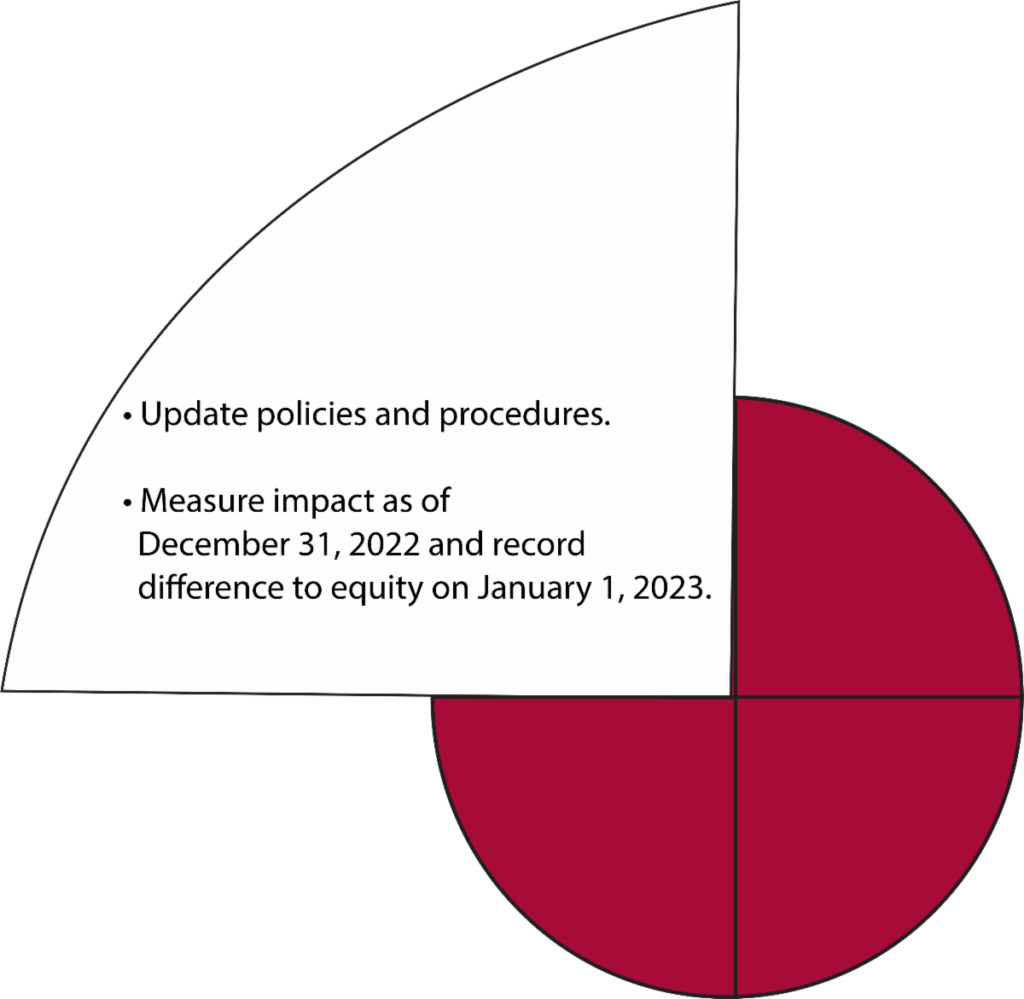

4th Quarter 2022

How can AHP help?

Preliminary CECL Model Review Prior to Implementation

- Gain an understanding of your process, controls, and how your model works.

- Review methodology to determine if it is in accordance with GAAP.

- Review management’s assumptions and support for the assumptions that were used.

- Review your impact analysis and CECL model output compared to current methodology.

If you are a current internal audit client, we can incorporate this into your internal audit plan.

If you are a financial statement audit client, we can perform this review as an extended procedure to your audit prior to implementation.

If you are not yet an AHP client, we’d love to start a relationship with you!

Consulting

In addition to providing a preliminary review of your model, we are always happy to provide consulting and advice on questions that arise during the implementation process.

Please contact your engagement executive or Rebekah Kilpatrick at rebekah.kilpatrick@ahpplc.com so we can assist you during the CECL implementation process.

Rebekah Kilpatrick, CPA, CRCM

Senior Manager

rebekah.kilpatrick@ahpplc.com

989-497-5300