Like a slowly gathering storm, inflation has gone from dark clouds on the horizon to a noticeable downpour on both the U.S. and global economies. Is it time for business owners to panic?

Weathering the storm of rising inflation

Like a slowly gathering storm, inflation has gone from dark clouds on the horizon to a noticeable downpour on both the U.S. and global economies. Is it time for business owners to panic?

Sales and registrations of electric vehicles (EVs) have increased dramatically in the U.S. in 2022, according to several sources. However, while they’re still a small percentage of the cars on the road today, they’re increasing in popularity all the time.

Under IRS regulations regarding electronic consents and elections, if a signature must be witnessed by a retirement plan representative or notary public, it must be witnessed “in the physical presence” of the representative or notary — unless guidance has provided an alternative procedure.

If you’ve recently begun receiving disability income, you may wonder how it’s taxed. The answer is: It depends.

Like many businesses, yours has probably jumped aboard the cloud computing bandwagon … or “skywagon” as the case may be. How’s that going? Some business owners pay little to no attention to a cloud provider once the service is in place. Others realize, perhaps years later, that they’re not particularly satisfied with the costs, features and cybersecurity measures of their cloud vendors.

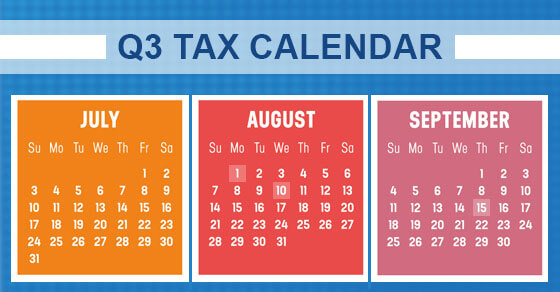

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact Andrews Hooper Pavlik PLC to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Accounts payable is a critical area of concern for every business. However, as a back-office function, it doesn’t always get the attention it deserves. Once in place, accounts payable processes tend to get taken for granted. Following are some tips and best practices for improving your company’s approach.

As a result of the current estate tax exemption amount ($12.06 million in 2022), many people no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because many estates won’t be subject to estate tax, more planning can be devoted to saving income taxes for your heirs.

Every business wants to engage in strategic planning that will better position the company to sell more to current customers — and perhaps expand into new markets. Yet the term “strategic planning” is so broad. It’s easy to get overwhelmed by all the possible directions you could go in and have a hard time choosing a path. Here are a few simple ways to make strategic planning a reality.

Some people who begin claiming Social Security benefits are surprised to find out they’re taxed by the federal government on the amounts they receive. If you’re wondering whether you’ll be taxed on your Social Security benefits, the answer is: It depends.