If you’ve recently begun receiving disability income, you may wonder how it’s taxed. The answer is: It depends.

How disability income benefits are taxed

If you’ve recently begun receiving disability income, you may wonder how it’s taxed. The answer is: It depends.

Like many businesses, yours has probably jumped aboard the cloud computing bandwagon … or “skywagon” as the case may be. How’s that going? Some business owners pay little to no attention to a cloud provider once the service is in place. Others realize, perhaps years later, that they’re not particularly satisfied with the costs, features and cybersecurity measures of their cloud vendors.

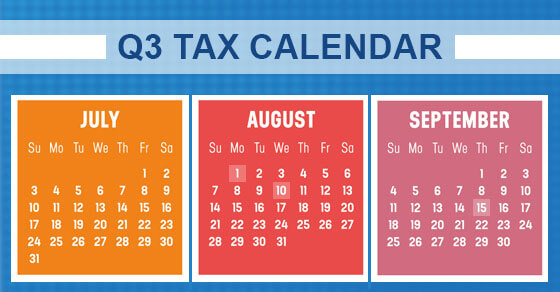

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact Andrews Hooper Pavlik PLC to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Accounts payable is a critical area of concern for every business. However, as a back-office function, it doesn’t always get the attention it deserves. Once in place, accounts payable processes tend to get taken for granted. Following are some tips and best practices for improving your company’s approach.

As a result of the current estate tax exemption amount ($12.06 million in 2022), many people no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because many estates won’t be subject to estate tax, more planning can be devoted to saving income taxes for your heirs.

Every business wants to engage in strategic planning that will better position the company to sell more to current customers — and perhaps expand into new markets. Yet the term “strategic planning” is so broad. It’s easy to get overwhelmed by all the possible directions you could go in and have a hard time choosing a path. Here are a few simple ways to make strategic planning a reality.

Some people who begin claiming Social Security benefits are surprised to find out they’re taxed by the federal government on the amounts they receive. If you’re wondering whether you’ll be taxed on your Social Security benefits, the answer is: It depends.

Businesses with multiple owners generally benefit from a variety of viewpoints, diverse experience and strategic areas of specialization. However, there’s a major risk: the company can be thrown into tumult if one of the owners decides, or is compelled by circumstances, to leave.

The downturn in the stock market may have caused the value of your retirement account to decrease. But if you have a traditional IRA, this decline may provide a valuable opportunity: It may allow you to convert your traditional IRA to a Roth IRA at a lower tax cost.

You can’t stop it; you can only hope to use it to your best business advantage. That’s right, summer is on the way and, with it, a variety of seasonal marketing opportunities for small to midsize companies. Here are three ideas to consider.