Keeping up with employment regulations and health care benefits can be a struggle for many small to midsize businesses. One potential solution is engaging a professional employer organization (PEO).

Could your business benefit from a PEO?

Keeping up with employment regulations and health care benefits can be a struggle for many small to midsize businesses. One potential solution is engaging a professional employer organization (PEO).

still giving business owners plenty to think about. The nation’s gross domestic product unexpectedly contracted in the first quarter of 2022. Rising inflation is on everyone’s mind. And global supply chain issues persist, spurred on by events such as the COVID-19 lockdowns in China and Russia’s invasion of Ukraine.

If you donate valuable items to charity, you may be required to get an appraisal. The IRS requires donors and charitable organizations to supply certain information to prove their right to deduct charitable contributions. If you donate an item of property (or a group of similar items) worth more than $5,000, certain appraisal requirements apply.

Among the many lasting effects of the pandemic is that some businesses are allowing employees to continue working from home — even now that the most acute phases of the public health crisis seem to be over in some places. This decision is raising some interesting questions about fringe benefits.

The tax filing deadline for 2021 tax returns is April 18 this year. After your 2021 tax return has been successfully filed with the IRS, there may still be some issues to bear in mind.

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million households owned mutual funds in mid-2020. But despite their popularity, the tax rules involved in selling mutual fund shares can be complex.

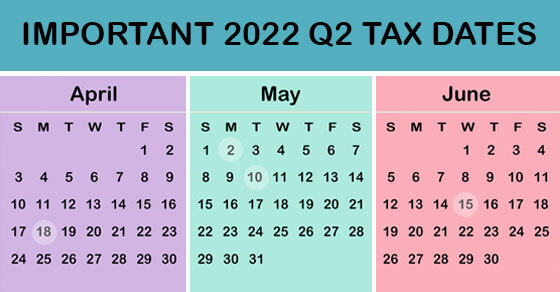

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year.

Business owners are regularly urged to “see the big picture.” In many cases, this imperative applies to a pricing adjustment or some other strategic planning idea. However, seeing the big picture also matters when it comes to managing the performance of your staff.

Once a relatively obscure concept, “income in respect of a decedent” (IRD) may create a surprising tax bill for those who inherit certain types of property, such as IRAs or other retirement plans. Fortunately, there may be ways to minimize or even eliminate the IRD tax bite.