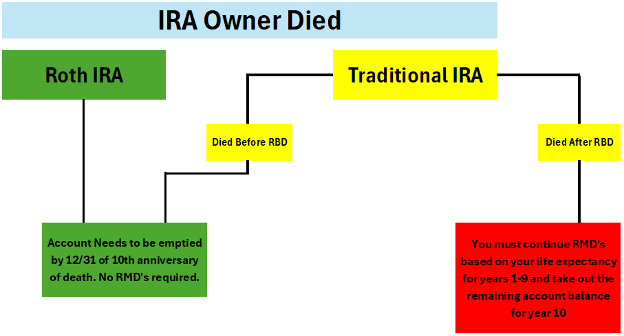

With the final regulations of the SECURE 2.0 Act now issued, some changes have occurred regarding inheriting IRA’s. The primarily controversial requirement of the act states that some beneficiaries must take Required Minimum Distributions (RMD’s) throughout a 10-year period if the original account holder died on or after their Required Beginning Date (RBD). With this, there are some additional major tax implications stating that some inherited IRA’s must also be fully distributed/emptied within the 10-year period of inheritance. Here is a summary of the updated requirements and what account owners and beneficiaries should prepare for.

When does an IRA fall under the 10-year rule?

An IRA falls under the 10-year rule when a Non-eligible Designated Beneficiary (NEDB) inherits an IRA or an Eligible Designated Beneficiary (EDB) elects to use the 10-year rule upon inheritance of an IRA.

- Eligible Designated Beneficiaries (EDB) are the owner’s surviving spouse, the owner’s minor child, a person who is disabled, someone who is chronically ill, or someone who is not more than 10 years younger than the owner.

- A Non-Eligible Designated Beneficiary (NEDB) is anyone other than an EDB.

When an inherited IRA applies to the 10-year rule, the beneficiary must fully empty the account by the end of the 10th year from the original owner’s date of death (Note that the 10-year inheritance rule can only apply to IRA accounts inherited in the year 2020 and after).

RMD’s & the 10-Year Rule

The other major change/implication of the new 10-year rule revolves around RMD’s. If the original owner of the IRA has reached their Required Beginning Date (RBD) then they must start taking their RMD’s.

- The Required Beginning Date (RBD) for taking RMD’s from traditional IRA’s is April 1st, the year after someone turns 73.

- If the owner dies before RBD, the beneficiary does not need to take any RMD’s.

- Non-spouse Roth IRA beneficiaries are subject to RMD’s as well, but account owners do not have an RBD.

RMD’s can be thought of as a switch where once on, it cannot be turned off. This continues to the beneficiary where they must continue RMD’s. Due to the confusion based around the act, the IRS has forgiven penalties for beneficiary RMD’s not taken from 2021-2024, but in 2025, RMD’s are required. A 25% penalty will be charged towards any RMD’s not taken. IRAs passed on to a second beneficiary follow the same RMD rules as the original beneficiary, and the 10-year rule applies only to the original account owner’s date of death.

Examples

Sandra (56) inherits a traditional IRA account from her father (85) who passed away in December of 2020. Sandra’s father was over his RBD and took an RMD in June 2020, so she will continue to take RMD’s from the account based on her life expectancy for years 1-9 (2021-2029). Sandra did not take out any RMD’s for 2021, 2022, 2023, and 2024. Due to the grace period of the Secure 2.0 Act, Sandra does not have to pay penalties on these missed RMD’s but is still required to continue taking RMD’s from 2025-2029. Finally, in 2030, Sandra must take a final distribution for the remaining amount of the account.

Sandra (56) inherits a traditional IRA account from her father (85) who passed away in December of 2020. Sandra’s father was over his RBD and took an RMD in June 2020, so she will continue to take RMD’s from the account based on her life expectancy for years 1-9 (2021-2029). Sandra did not take out any RMD’s for 2021, 2022, 2023, and 2024. Due to the grace period of the Secure 2.0 Act, Sandra does not have to pay penalties on these missed RMD’s but is still required to continue taking RMD’s from 2025-2029. Finally, in 2030, Sandra must take a final distribution for the remaining amount of the account.

Rebecca (43) inherits a traditional IRA account from her mother (75) who passed away in January of 2026. Rebecca’s mother was over her RBD, but did not take her RMD in 2026. Rebecca will continue to take RMD’s from the account based on her life expectancy for years 1-9 (2026-2035). Rebecca must start taking RMD’s in the same year that her mother passed because an RMD was not yet taken for that year from the account. Finally, in 2036, Rebecca must take a final distribution for the remaining amount of the account.

Darnell (64) inherits a traditional IRA account from his mother (84) who passed away in 2025. Darnell’s mother was over her RBD and took her RMD in 2025. Darnell continues taking RMD’s years 2026-2027 before passing away in 2027. Darnell names his daughter Emma (17) as the new beneficiary of the account. Emma therefore must continue RMD’s based on Darnell’s life expectancy for the years 2028-2034. Finally, in 2035, Emma must take a final distribution for the remaining amount of the account based on her grandmother’s date of death.